BUDGET HIGHLIGHTS – Capital Markets

Let’s get straight to what was expected by everyone but didn’t happen in the Budget.

- No changes in Capital Gain Tax Structure.

- No changes in 80C Deduction Limit.

- No Increase in Personal Income Tax

- No Increase in the exemption of interest component of Housing Loans.

Major Changes Announced

This Budget has closed various tax saving loopholes which were used aggressively to market various structured products.

- Market Linked Debentures (MLD)

All MLDs, listed or otherwise, will be taxed as short term capital gains, at redemption or sale, even if it’s after 1 year (any time period)

The capital gains are classified as debt (not equity, even if the MLD is equity based). Plus indexation benefit is also not there.

Income will be taxed at marginal tax rate & hence this product makes little sense henceforth.We had completely avoided MLDs for a long time as we knew the loophole had to be plugged sometime. Also, MLDs have high liquidity & credit risk.

- Life Insurance Policies ( excluding ULIPs)

After April 1, 2023, any insurance policy that is issued, where the premium is more than 5 lakh, will have a tax implication on the gain.

(Older policies are not affected)

Kindly note that proceeds received on death are still tax free.

Many guaranteed products fetching 7% were aggressively marketed instead of FDs as post tax returns were high.

This is the major reason why most of the Life Insurance companies like HDFC Life, SBI Life tanked yesterday by more than 10%.

No tax on Term Insurance which we believe all working individuals should have. This is the cheapest form of life insurance one can buy & secure their families future.

- Tax will be deducted at source for all listed Debentures

Interest paid on listed debentures will now attract 10% TDS, which means you will receive less cash flow starting 1st April 2023 than earlier. This is not a big problem since this income was taxable anyhow, but many people got away without declaring this income. Now, you will see some TDS deducted before you receive interest.

Kindly note that 10% TDS will be deducted on interest payout from 1st April 2023 onwards on Bonds, NCDs etc.

- Housing double tax exemption benefit taken out

If you took a house using a loan, then the interest paid – or part of it – can be reduced from your income as tax (and you can even claim a loss from house property).

When you sell that house, you can take the entire interest – regardless of whether it was used for a tax exemption earlier – and use it as a cost to reduce your actual capital gains realised.

Since this is a double advantage, Budget 2023 has addressed it by saying: use one of the two. If you’ve claimed an exemption for the interest, it can’t be used as a cost to reduce your capital gains. Net negative for the real estate industry.This used to make a huge difference in tax liability. - REITs and InvITs: Some tax advantages removed

Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) are collective investment vehicles that either own commercial rent-generating real estate or infrastructure projects. The cash flow from these projects typically comes in three types: - they pay dividends to the trust, which will distribute them to unit holders (taxable)

- they pay interest on debt taken from the trust, which again is given to unit holders (taxable)

- they return the principal on the debt taken from the trust, which when distributed is not taxable for unit holders.

The last bit – where principal is returned to unit holders and isn’t taxed – has now been changed. From April 1, 2023, any sort of income received from an REIT or InvIT is fully taxable in the hands of unit holders.We could see some large return of principal until 1st April 2023. This may sound wrong in general as you may ask why the government is taxing your principal, but trust us this is the right thing to do as the accounting is pretty complicated and we will get into the details some other time. - Capital gains, which can be reinvested, are restricted to Rs 10 crore. Capital gains above Rs 10 crore will be taxable.Currently, any capital gains – in stocks, gold, real estate or even startups – can be invested in a residential house. Any amount qualifies. Even 500 crores. But the policy wasn’t created to encourage the super rich to buy ultra-expensive houses – it was done to encourage housing.

So the rule’s changed: Only Rs. 10 cr. worth of gains can be parked in a residential house. On the rest, you have to pay whatever capital gains tax is applicable.

This also applies if you own a very expensive house and you want to sell it and buy another very expensive house. Only 10 cr. worth capital gains can be offset in buying the new house. This was used by many startup founders / early employees to avoid paying tax on their capital gains.

- Hike in TCS (Tax Collected at Source) on overseas travel, fund remittances out of India to 20% (other than for Education and medical purpose)

From 1 July 2023, the TCS is increased to 20% with no base limit. That means every dollar (or any currency) spent via LRS abroad has a 20% extra amount that’s collected at source. You can then adjust it against other tax payable, or claim it as a refund at the end of the year. This is a damper as it leads to higher initial outflow in tax collected at source, which blocks funds unnecessarily.

Direct international stock investing now will be difficult. The government wants to encourage spending & investing inside India.

Personal Income Tax

The government is clearly pushing the new income tax regime which is very straightforward, but it doesn’t have most of the lucrative deductions & exemptions. The Finance Minister also said that from now onwards the New Tax regime will be the default option on the income tax portal.

Standard deduction of Rs. 52,500 has been introduced in the new regime for income above Rs. 15.5 L.

- Rebate limit: Rebate limit increased to Rs 7 lakh in the new tax regime from Rs 5 lakh.

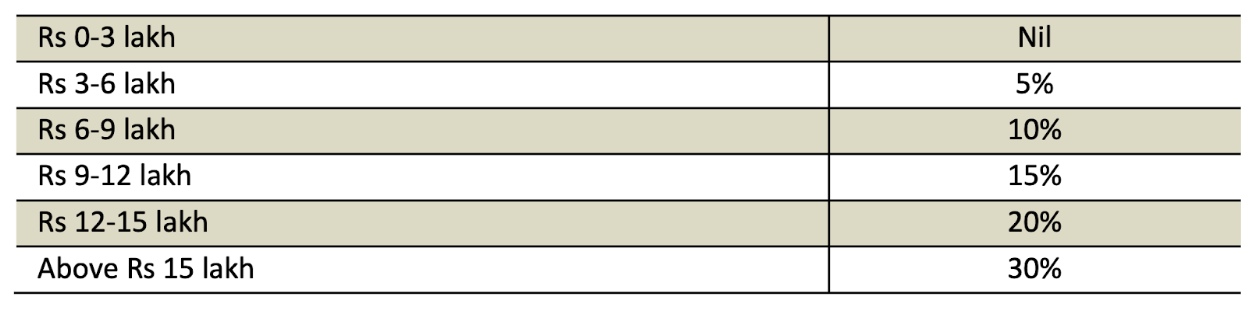

- Change in tax Structure: Reduced the number of slabs to five and increased the tax exemption limit to Rs 3 lakh (from Rs 2.5 lakh) in the new personal income tax regime.

- Reduced the highest surcharge rate from 37% to 25% in the new tax regime; resulting in reduction of the maximum tax rate to 39% from 42.74%.

The new tax rates are:

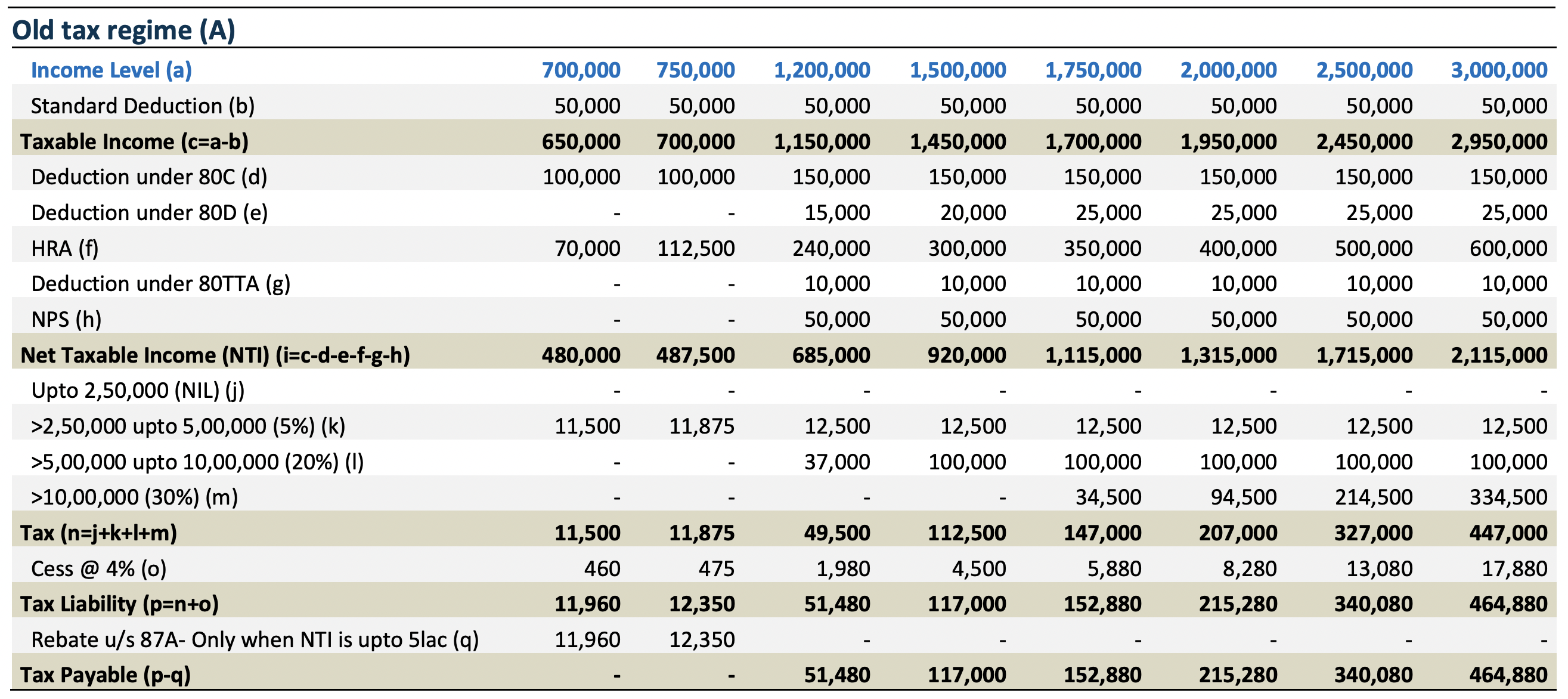

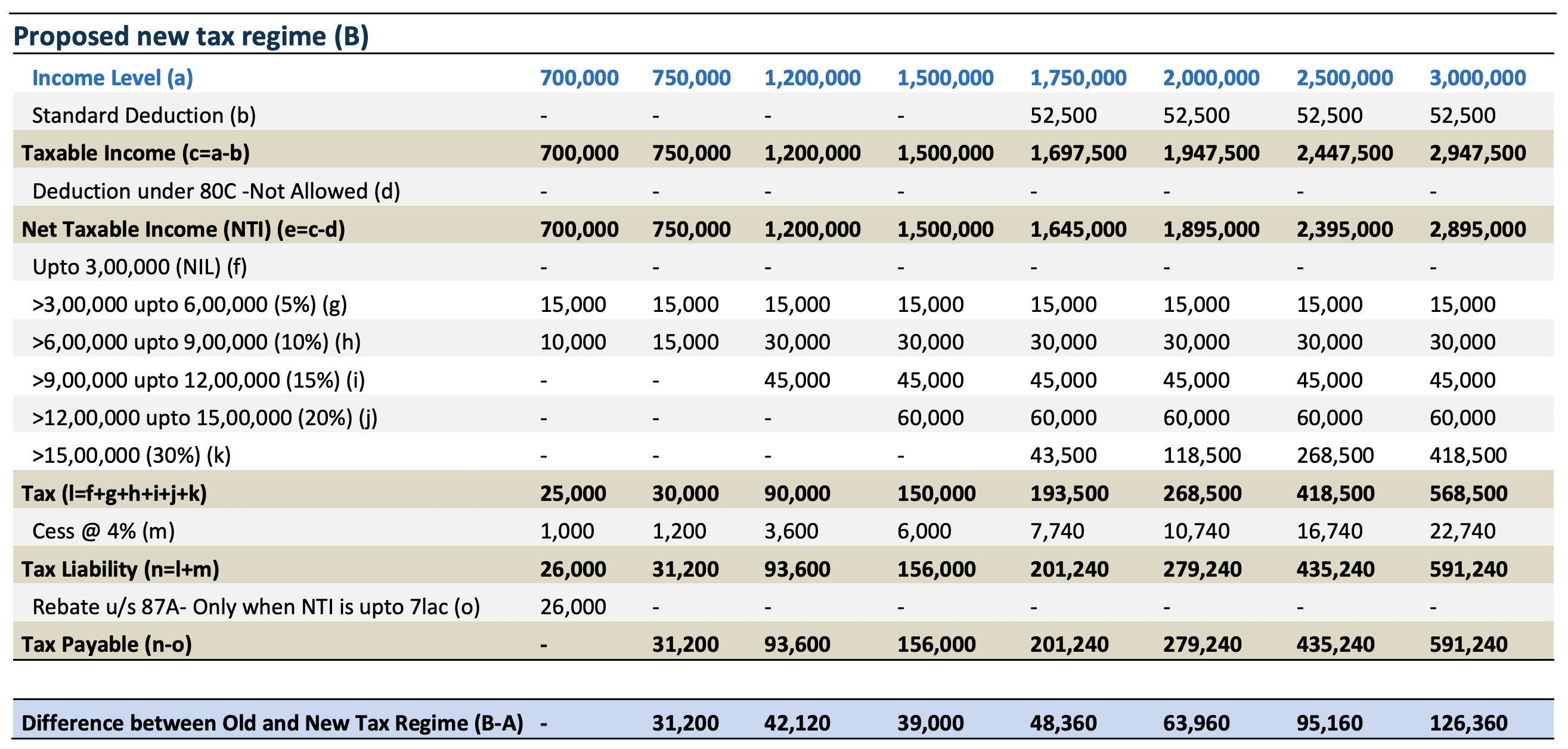

Comparison between Old & New Regime is as follows-

Our Take-

Given the way tax loopholes are being closed, we strongly believe Debt Mutual Funds remain the most efficient way of investing in the long run. We have been quite active in this space & we continue to believe this is the right way for most of the investors falling in the higher tax bracket

We understand this is a bit complicated. Hence, we believe that one should consult an unbiased Advisor before investing especially in Insurance since the commitment is for a long duration.

Disclaimer-

This is just our view on the Budget. Kindly consult your CA or Tax Advisor for further details. This report is not any recommendation. This is just our interpretation of the Budget and there could be some changes in the fineprint. No stocks mentioned above are recommendations.