Affle (India)

Company Brief

Established in 2006, Affle India is a global technology company with proprietary consumer intelligence platform that delivers consumer acquisition engagement and transaction through relevant mobile advertising.

The company help global brands to enhance their return on marketing investment through contextual mobile ads and also by reducing digital ad fraud, here contextual ad means that the ads are placed as per the content of the page or the interest of the person for eg. If you visit Moneycontrol, you would see ads of companies like brokerage houses or a mutual fund house promoting their mutual funds or other investment services. Affle India uses artificial intelligence, machine learning and deep learning algorithms to generate consumer insight for better targeted marketing.

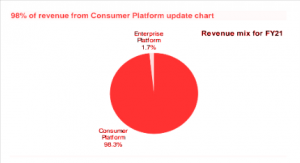

If you look at businesses breakup, Affle India has two major business segments, first is Consumer Platform business and second is Enterprise platform segment. Their consumer platform business is all about helping brands in acquiring customers through relevant mobile ads. Affle India holds a leading market position in India and a strong competitive advantage in mobile ad business. In the enterprise business category they provide services like mobile app development for third party building e-commerce websites and apps for business and also provide data analytics services to generate better insights. In terms of revenue breakup, consumer business is the largest contributor with 99.1% contribution in Affle India’s revenue and enterprise platform contributed 0.9% in Q2FY22.

Investment Rationale

Affle India is better placed to capture opportunities from favourable industry tailwinds and it can be a first-mover advantage in emerging markets given its competencies in both in-app and on-device ecosystems, and end-to-end offerings in the CPCU (Cost Per Converted User) business model.

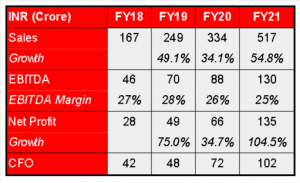

We like Affle given its strong balance sheet, greater adoption of its platform, strengthening relationships with advertisers directly and a long runway for growth. We expect Affle India’s revenues and earnings to report a CAGR of 30% and 27% respectively, over FY2022-FY2024E.

Industry Overview

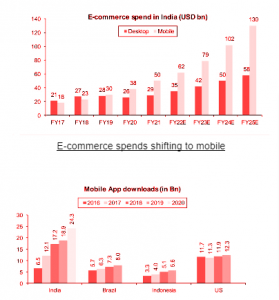

Covid has moved India online

Increasing Mobile Usage

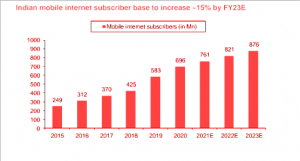

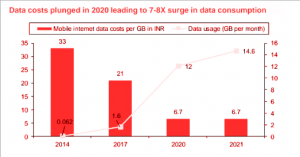

- Data consumption to triple in next 5 years: On an average Indians consume 14.6 GB data per smartphone per month, second highest globally, and this is expected to triple over next five years, according to Ericsson mobility report 2021.

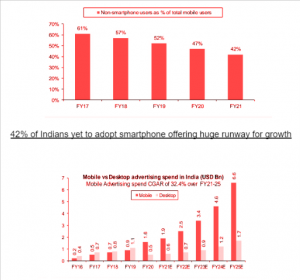

- Mobile is becoming the preferred mode of internet: Given affordability of smartphones over PCs, almost 72.6% of internet users will access the web solely via their smartphones by 2025 as per World Advertising Research Center. Most of the growth in smartphone usage will come from China, India, Indonesia & Nigeria.

- Consumers are spending more time on mobile: Due to Covid, screen time has tremendously increased, consequently creating a lot more internet traffic and a lot more impressions and clicks. In India the time spent in front of mobile devices rose 39.4% from 3.3 hours per day in CY19 to 4.6 hours in CY20.

Mobile is now preferred channel for digital advertising

Mobile app downloads in India grew by 28.6% y/y in CY20

Share of mobile in digital media spends jumped to 76% in last two years

Affle’s focus on fast growing emerging markets

Affle’s focus is disproportionately on emerging markets and within that India (39% of revenue share) is their dominant market.

- In emerging markets there is huge growth potential due to – 1) higher number of smartphone users, 2) low smartphone penetration 3) huge gap between number of smartphone users and those who shop online on smartphone. Digital advertising is expected to grow at a slower pace at 11.2% CAGR in the US over 2020-25E vs 30%/20-25% in India/Other emerging markets.

- There is greater competition in developed markets with the majority of global players focussed on US and Europe as compared to emerging markets of India, SEA where Affle primarily operates. Therefore, higher investment in sales is required to build on-ground presence and scale in developed markets.

Recently Affle acquired Argentina based mobile advertising company Jampp in order to expand presence in the LATAM region. As Jampp has some presence in the US, Affle gets access to on-ground local presence in the US through this acquisition. In Q4FY20 as well it acquired Mediasmart which gave access to Europe & LATAM region.

Affle’s priorities in terms of market expansion are:

- To dominate and become market leader in India

- Be amongst top few players in emerging markets

- Aspire to become global leader

Affle’s business segments

Affle operates two business platforms

- Consumer Platform

- Enterprise Platform

Consumer Platform primarily provides new consumer conversions (acquisitions, engagements and transactions), retargets existing consumers (by taking them closer to transactions) and offers online to offline (“O2O”) platform that converts online consumer engagement into measurable in-store walk-ins.

Affle primarily earns revenue from Consumer Platform via:

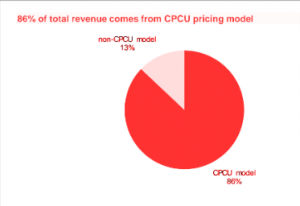

- CPCU (91.6% of rev.): Cost Per Converted User basis pricing model (i.e. cost per install, cost per action, cost per transaction etc.)

Consumer platform facilitates 1) High ROI driven CPCU pricing model, 2) Has strong capabilities across ad-tech ecosystem, 3) Enables Programmatic advertising, 4) Business benefits from network effects, 5) Superior results in challenging Indian markets, and 6) Devises anti-fraud capabilities.

- Non-CPCU (8.4% of revs): Includes impression based on CPM (Cost per million impressions), retargeting, online to offline conversion and other marketing spends.

- Enterprise Platform provides end-to-end solutions to enterprises for enhancing their engagement with mobile users, such as developing Apps, enabling offline to online commerce for offline businesses with e-commerce aspirations and providing enterprise grade data analytics for online and offline companies.

Credible player with strong anti-fraud capabilities

- Ad-fraud has been a pain point for advertisers: Ad fraud occurs when digital traffic is manipulated to give the impression of successful ad-campaign performance, while in reality the quality suffers. This fraud can be technical (bots or malware) or human (illegitimate traffic).

- The ad-fraud report released by techARC in August 2020, projects ad fraud rates to go up in the range of 45-55% post covid compared to present industry average of 25-35%.

- Mobile remains the riskiest channel for ad fraud. In 2019, Mobile Marketing Association in India reported that 20% of digital ad budgets fall victim to ad fraud and mobile advertising accounts 62% of total digital ad fraud.

Affle developed mFaaS (Mainframe as a Service) in June 2017 to tackle ad-fraud issues:

- mFaaS enables mobile advertisers and networks to detect and prevent mobile ad fraud not only at a post-mortem level, but during runtime too.

- It processes massive volumes of click and conversion data using complex machine learning algorithms to detect fraud. It is currently used globally to detect and reduce ad fraud for campaigns of many top marketers.

- mFaaS analyses 15+ reason codes that identify a wide variety of frauds including Click or downstream event hijacking, Click spamming, BOT activities, IP Fraud, Device fraud and many more.

- The company uses this platform for its own mobile advertising display and also licenses this platform for a fee.

Consumer platform facilitates high ROI (Return on Investment) driven by CPCU pricing

Affle receives revenue only when users perform one of the deep funnel conversion events. Hence, highly accurate real time targeting capability is essential to profitably scale up the CPCU pricing model. Affle’s consumer platform (98% of revenue share) is capable of accurately targeting real shoppers from a large set of users while simultaneously reducing real-time ad frauds. Consumer platform powers all three CPCU use cases i.e. 1) New user acquisition, 2) re-targeting users to complete transactions and 3) online to offline conversions.

What is the CPCU based pricing model?

While the industry is largely dominated by companies operating on cost per clicks (CPC), cost per mile (CPM) i.e. views and impressions Affle is very well differentiated as it operates on ‘Cost per Converted User’ (CPCU) based pricing. It is an outcome based pricing model wherein conversions are linked to the deep funnel matrix which are post click and post install events (purchase, add to cart etc.) done by the consumers on their smart-devices. This means Affle receives revenue only when a user performs these events (example: transacts through mobile app). This offers a much better value proposition to clients compared with other advertising solutions that rely largely on the number of clicks or visits per web page.

Why does Affle prefer CPCU based pricing?

- Advertising industry is shifting towards performance based pricing

- CPCU model provides superior ROI for clients, lowers ad-fraud rate, improves ad-quality and user experience

- It improves customer stickiness and places Affle as a strategic partner in the client’s digital marketing strategy.

Issues in other forms of pricing such as cost per thousand impressions (CPM) or views (CPV):

Ad visibility: Ads may be located at the bottom of the page and may not be visible unless a user scrolls down, but these are still counted as a delivered impression in a CPM model

Ad quality: CPM models offer less incentive to the ad tech player for improving quality of ad placements through better targeting and engaging content

Unmeasurable: There is no way to determine the attribution of leads.

Consumer platform enables programmatic advertising

Digital advertising is tendered either through direct advertising or through programmatic advertising. Direct advertising involves significant human intervention to auction ad spaces and fix pricing, whereas programmatic advertising is completely automated. Affle’s end-to-end connected consumer platform also uses ‘programmatic advertising’ i.e. the entire process of placing ads and delivering user conversions is completely automated. Programmatic advertising enhances the ability of advertisers to target users with pin-point accuracy in real time.

How programmatic ad-buying works?

- Programmatic advertising process starts when a user arrives on a website/app. Publishers provide details of the available ad space and user profile to supply-side platform

- Supply Side Platforms (SSPs) aggregates ad inventory from multiple publishers and analyses user’s data to place the data in an appropriate ad-exchange. SSP then opens up bidding options for advertisers through an ad-exchange.

- Ad-exchanges hosts aggregates multiple such open bidding options from SSPs and allows Demand side platforms (DSPs) to bid for ad-spaces on a real time basis. DSPs evaluate the users worth based on target profile of the advertisers campaign, user data received through SSP, data from Data Management Platform (DMP) and fraud detection platform. (mFaaS)

- DSP then submits a bid to the ad exchange, based on value assigned to user data. Higher bidder wins the bid. Supply-side platform allocates ad space to the advertiser who then supplies ad and completes payment process, after which ad is displayed at the publisher.

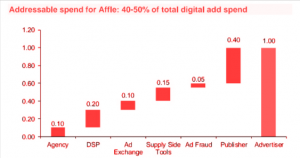

Ad-tech companies like Affle typically cater to 40-50% of overall digital ad-spend through presence in DSP, SSP & Fraud detection. Ad-tech vendors retain higher share (50-60%) in case of direct relationship with clients as compared to catering through Ad agencies.

Affle’s 2.0 strategy

Affle 2.0 strategy is anchored on OEM partnership, Vernacular and Verticalization. It aims to reach more than 10Bn connected devices including mobile smart phones, connected TV, smart wearables and out-of-home screens to enable integrated omni-channel online and offline consumer journeys. The company aspires to drive sustainable, innovation led profitable growth through this strategy.

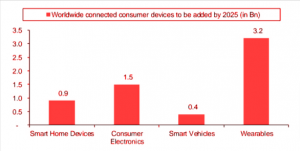

6 Bn new connected consumer devices to be added by 2025 globally

Ecosystem level partnerships: Partnership with mobile OEMs, operators and publishers enables Affle to do holistic advertisement on the OEM device as compared to only in-app ads earlier.

Vernacular focus enables hyper personalized consumer recommendations and targeting the next set of users coming from Indian rural areas and South East Asian countries where native/regional languages are predominant.

Verticalization focus on top 10 high growth, resilient internet sector verticals such as E-commerce, Fintech, Foodtech, Edtech, Gaming etc. will enable Affle to drive deeper insights in these verticals leading to greater ROI impact for clients.

Affle’s Acquisitions

Affle has been scaling up the value chain by adding more capabilities through acquisitions and strategic investments. This enables them to expand their addressable opportunity and ride through the entire business value-chain.

It has added innovative capabilities and invested in upcoming areas such as Proximity marketing (Mediasmart), Omni-channel marketing (Vizury & Shoffr), Re-engaging users, (RevX), On-device App discovery (Appnext, DiscoverTech), vernacular & interactive Keyboard to enable conversational marketing (Bobble AI) etc.

Affle’s strategic acquisitions and investments – scaling up the value chain

Affle’s user acquisition and engagement solutions help apps, businesses and brands to discover their most valuable customers. Advertise with greater transparency, control and efficiency with the platforms that are driven by data science.

- App Discovery at scale through integrated consumer journeys

- On-device app discovery solutions that blend into the users’ mobile experience enabling a personal, incomparably intuitive experience

- Personal and contextual app recommendations whereby highly-intent users can discover apps intuitively

- Out of the Box Experience (OOBE): a seamless onboarding experience that successfully navigates a user’s first experience with their device

- Appnext ‘Timeline’- A patented AI technology that displays contextual and personal app recommendations within a myriad of apps

- Unified Audience Platform for Mobile User Growth

- Single unified access of channels across directly integrated publishers, programmatic platforms and app recommendations

- Unify the audiences on a single dashboard for greater transparency

- Access consolidated supply sources to drive scale and get actionable insights across channels

- Diversified technology, creative and KPI-based optimization, and precision targeting

- Made for Growth, Built for App Marketers

- 100% programmatic and fraud-less environment

- Find the right users where they are based on contextual data

- Advanced DS models to target LAT inventory efficiently to drive maximum performance

- Creative sophistication in ad campaigns to bring those users to you.

About Jampp

Affle acquired 100% stake in Jampp (including tech IP assets),a programmatic mobile advertising company helping clients acquire new users and drive repeat in-app engagements. The company started in 2013 in LATAM and its majority employee base of ~100 is based out of Argentina.

Benefits and synergies to be derived from this acquisition:

- Scale up Affle’s revenue: Jampp’s CY20 revenue of USD 29.5 mn or INR 2.1 Bn (~42% of Affle’s FY21 revenue of INR 5.2 Bn) will add scale to Affle’s overall business. Higher CPCU rates in LATAM and conversion to CPCU business model will also considerably increase CPCU rates and thus improve profitability.

- Access to LATAM and US: LATAM being the anchor market of Jampp, this acquisition is in-line with Affle’s strategy of expanding in Android heavy emerging markets. With local senior management and on-ground presence in LATAM, Affle aims to be market leader in this region within next 2-3 years.

- Jampp also has a niche vertical focused presence in some North American markets. Affle plans to tap the Android market in the US. With implementation of ATT by Apple (stricter privacy policy) advertising budgets are shifting towards Android which will further benefit Affle.

- Marquee client base: Jampp is well rated in Appsflyer index (13th rank in retargeting and 12th in growth index). Jampp will provide a marquee customer base within the same internet focused business (E-commerce, Foodtech, Travel-tech etc.) which are high growth verticals of Affle. Jampp’s clients include Twitter, Shutterfly, Boxed, Yelp, Grab, Fetch, Rappi, Deliveroo, Justeat, Shpock, Beat, Rapido, Centauro, Wabi, Rise etc.

- Upgrade in business model to drive higher profitability: Jampp’s business model is currently based on Cost per Install (CPI), similar to Affle’s focus on delivering conversions. However, Affle will upgrade this model to CPCU, deepening funnel conversion further, thus driving higher ROI for clients and improving profitability and CPCU rates of Jampp.

Founder, CMD & CEO – Anuj Khanna Sohum

- Anuj is a serial entrepreneur with 18 years of experience in leading tech & data platform-based businesses. He completed a bachelor’s degree in computer engineering from the National University of Singapore. He is also an alumnus of Harvard Business School (OPM) & Stanford GSB (SEP).

- He started his first startup at the age of 20 during undergraduate degree called “Anitus Technologies”. Anitus Tech was into knowledge and document management, and was acquired by Malaysian conglomerate MCSB, which renamed it myMCSB. His second startup “SecLore” was an information security company which was acquired by Herald Logic in 2007.

- He founded Affle by acquiring “Tejus Securities Private Limited” in Jan 2006. He aims to address industry challenges including digital fraud and data privacy through technology innovations. He ensures strategic alignment across all key stakeholders resulting in sustainable growth & value creation.

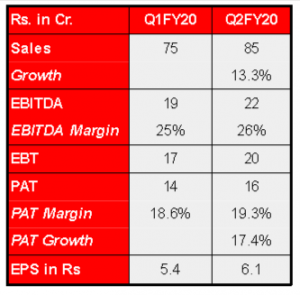

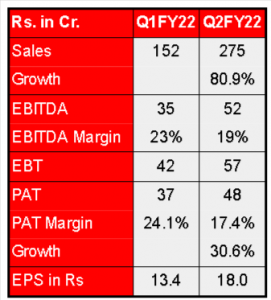

Quarterly Updates

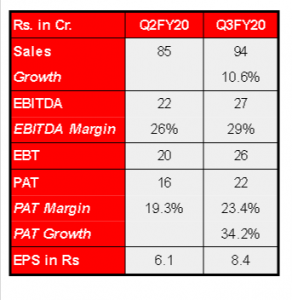

Q2FY20 Updates

- Revenue increased by 38.8% y-o-y, primarily driven by 39.4% growth in total converted users (CPCU Business), coming from both existing and new customers across key industry verticals including e-commerce, food, travel, transport, entertainment/OTT/gaming, healthcare, BFSI/fintech and others

- Strategically invested in the Inventory & Data Cost as a long-term strategy, to expand the reach across connected devices and building deeper insights towards the next billion shoppers, leading to an increase in the Inventory & Data Cost by 1.4% as a % of revenue

- Launched new Research & Development Centre in Bangalore to strengthen the focus on new technology innovations using AI & machine learning technologies

- Recognised as the ‘Technology Company of the Year’ & ‘Best in Show’ at MMA (Mobile Marketing Association) Smarties Awards 2019, Mumbai

Q3FY20 Updates

- The growth in CPCU business came from both existing and new customers, contributed by consistent growth in digital marketing spends by advertisers across industry verticals and across India & Other Emerging Markets.

- Continue to enhance the human resource capabilities to deepen our access towards emerging markets and building products & technology in the omnichannel marketing space, leading to an increase in Employee Expenses on a y-o-y basis. However, on a q-o-q basis, Employee Expenses have declined.

- Launched a new product Engage-360, Artificial Intelligence (AI)-Driven Omnichannel Marketing Platform which connects all devices and channels over its unified platform and delivers integrated consumer experiences across connected devices and allow marketers to craft unique consumer journeys to drive higher conversions and ROI powered by AI and ML algorithms.

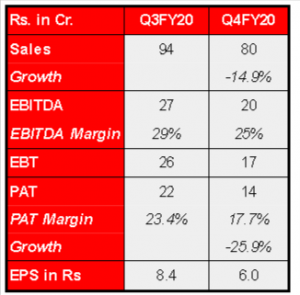

Q4FY22 Updates

- Top 10 customers concentration reduced in FY2020, from 64.5% to 45.5% (As a % of Consolidated Revenue)

- Natural shift in the select industry verticals where more advertisers are engaging directly than through their advertising agencies

- Won ‘IPO of the Year’ for the most successful IPO in 2019 at 2019 HURUN INDIA

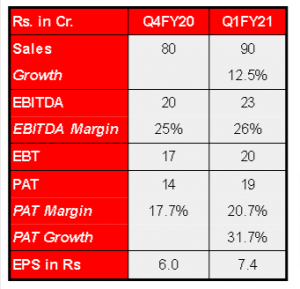

Q1FY21 Updates

- Top 10 verticals contributed over 90% revenue in Q1 FY2021 vs. 76% in Q4 FY2020

- CPCU business remained resilient, Non-CPCU business performed well, driven by higher customers’ demand for PaaS / SaaS based model and short-term inclination of advertisers towards brand advertising during the pandemic times.

- Converted users (mn) – 17, Average CPCU (Rs.) – 41

- Affle acquired full control of Appnext Pte. Ltd., Singapore and 100% IP of Appnext app discovery and recommendation platform.

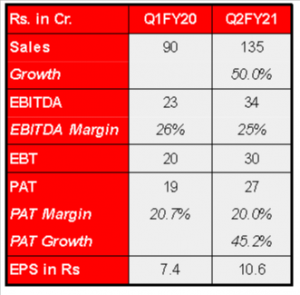

Q2FY21 Updates

- 85.2% of Consumer Platform revenue contributed by CPCU model in Q2 FY2021 and 14.8% from Non-CPCU.

- Covid-19 has accelerated the transition of organizations to mobile advertising.

- Converted users (mn) – 28.1, Average CPCU (Rs.) – 40.3

- Top 10 verticals contributed over 90% revenue in Q2 FY2021 in line with Q1 trend and vs. 76% in Q4 FY2020.

Q3FY21 Updates

- Consumer Platform: 98.3% 9M FY21 revenue

- Enterprise Platform: 1.7% 9M FY21 revenue

- 84.8% of Consumer Platform revenue contributed by CPCU model in Q3 FY2021 and 15.2% from Non-CPCU

- Affle2.0 strategy anchored on Vernacular, Verticalization, OEM partnership driving sustainable and innovation-led profitable growth

- With OOBE launch, Affle’s Appnext Platform to power an integrated on-device app discovery experience via its self-serve advertising platform to alter the way users discover apps while further strengthening our vernacular reach.

Q4FY21 Updates

- ROE (%) (Return on Equity) – 37.6%

- ROCE (%) (Return on Capital Employed) – 19.7%

- Converted Users (mn) – 29.6, Average CPCU (Rs.) – 40.9

- Enhanced human resource capabilities to deepen our technology and access towards emerging markets. This was to drive growth as an integrated in-app, on-device and proximity marketing platform with new innovations towards Connected devices, leading to an increase in Employee Expenses on a y-o-y basis.

Q1FY22 Updates

- Affle completed the acquisition to acquire full control, tech IP assets and 100% ownership of Jampp, a global programmatic mobile marketing company.

- Affle completed the patent transfer from Appnext Limited to Affle MEA FZ-LLC, an indirect wholly-owned subsidiary of the Company.

- 87.8% of Consumer Platform revenue contributed by CPCU model in Q1 FY2022 and 12.2% from Non-CPCU

- Converted Users (mn) – 31.5, Average CPCU (Rs.) – 42

Q2FY22 Updates

- The inventory and data cost during the quarter stood at 57.4% of revenue.

- The company reported a gain on revaluation of financial instruments worth ₹34 crore which aided the profits during the quarter.

- The company delivered broad-based growth in both the CPCU (cost per converted user) as well as non-CPCU business from existing and new customers across the top 10 industry verticals in India and global emerging markets.

- CPCU business continued to show strong momentum with 81.7% YoY growth in the conversions at 2.96 crore during Q4 FY21. Total converted users in FY21 stood at 10.53 crore.

- The management remains confident in delivering 25%-30% CAGR growth in the next 5 years which would be backed by strong macro tailwinds.

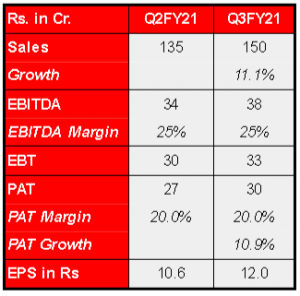

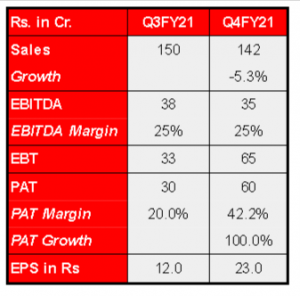

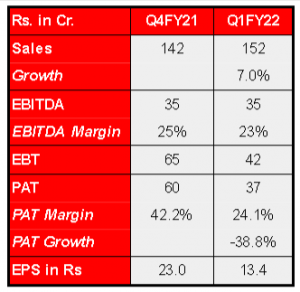

Financial Summary

Disclaimer – This is just a sample report, not an investment advice. Nirmiti Investment Advisors LLP and its investors have a vested interest in this company. Do consult your Financial Advisor before investing. Past performance does not guarantee future returns. Equity investments are subject to market risks.