Indian Accounting Standards simplified: Leases, Goodwill and Dividend

We have developed quite some skill with focusing on accounting standards and their effect on company sheets. As we at ProInvest believe in creating financial awareness we write our final series on Indian Accounting Standards Simplified. In this blog we will focus on few more factors of IND AS concerning:

- Leases

- Goodwill

- Dividend

Leases (IND AS 116)

What is a Lease? Lease is a contract under which one party agrees to provide land, property, equipment, services and in return the other party promises fixed payment for the same. Leases are quite common when a company does not plan to acquire land for its business as it may hold its reserves.

Lessor: The party of the transaction that owns the asset (land) and receives fixed payments for the same.

Lessee: The party of the transaction that receives the right to use the property for a fixed amount of years and pays fixed amounts for the same.

For Lessor there are two types of leases:

Operating lease – Lease that does not transfer substantially all the risks and rewards incidental to the ownership of an underlying asset.

Finance lease – Lease that transfers substantially all the risks and rewards incidental to the ownership of an underlying asset.

The accounting for lessor has not changed and is same as per old Ind AS/AS.

Factors for classification as finance lease:

There are 5 factors that determine whether a lease transfers substantially all the risks and rewards incidental to the ownership of an underlying asset. This assessment is to be performed when the lease is signed. Many companies are familiar with these five tests so we have summarized them below.

-

Ownership transfers to the lessee at the end of the lease.

-

The lease contains a bargain purchase option.

-

The lease term is for the major part of the economic life of the asset.

-

The present value of the lease payments are substantially all of the fair value of the asset.

-

The underlying asset is of such a specialised nature that it is expected to have no alternative use to the lessor at the end of the lease term.

The accounting for Lessee is as per financial lease only if and otherwise the asset leased is for a term of 1 year or less. In these circumstances of the lease period being less than 1 year, the lessee can treat the same as operating lease.

The standard provides a new method for lease accounting. As for lessee, the existing distinction between financial and operating leases (whereby the former was on the balance sheet, and the latter was off-balance sheet) goes away, and in case of every lease (other than exceptions, discussed below), the lease comes on the balance sheet as a right-to-use (RTU) asset and a corresponding lease liability representing its obligation to make lease payments.

Thus the companies need to show an equal asset on the balance sheet and a liability as well. This increases the transparency on the lease agreement. Along with this the depreciation and interest charged on the asset equals the amount of repayment of lease liability per period.

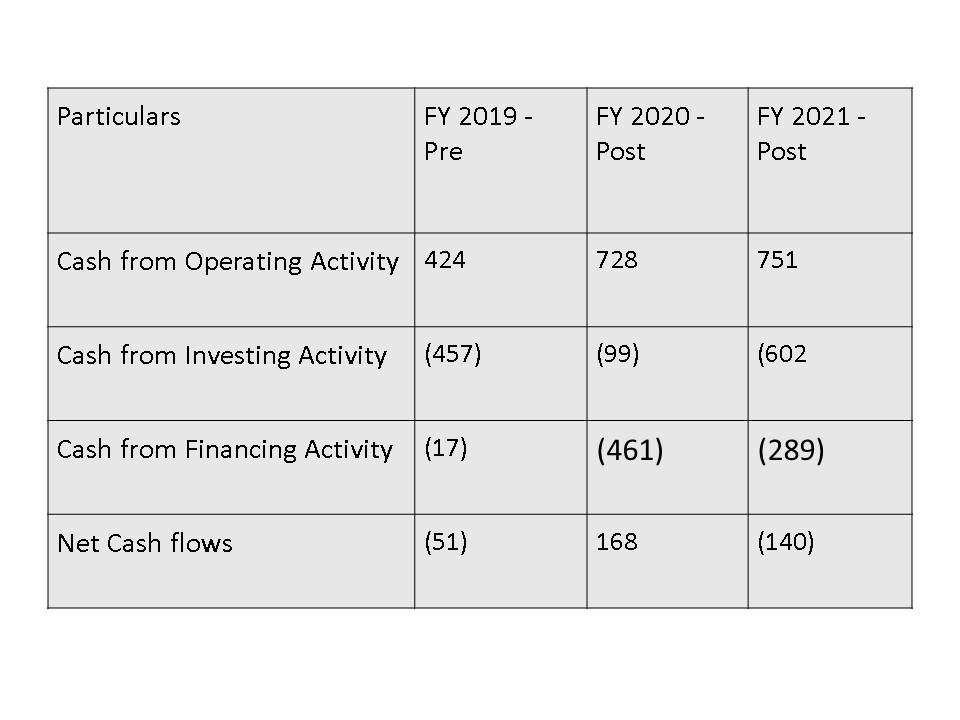

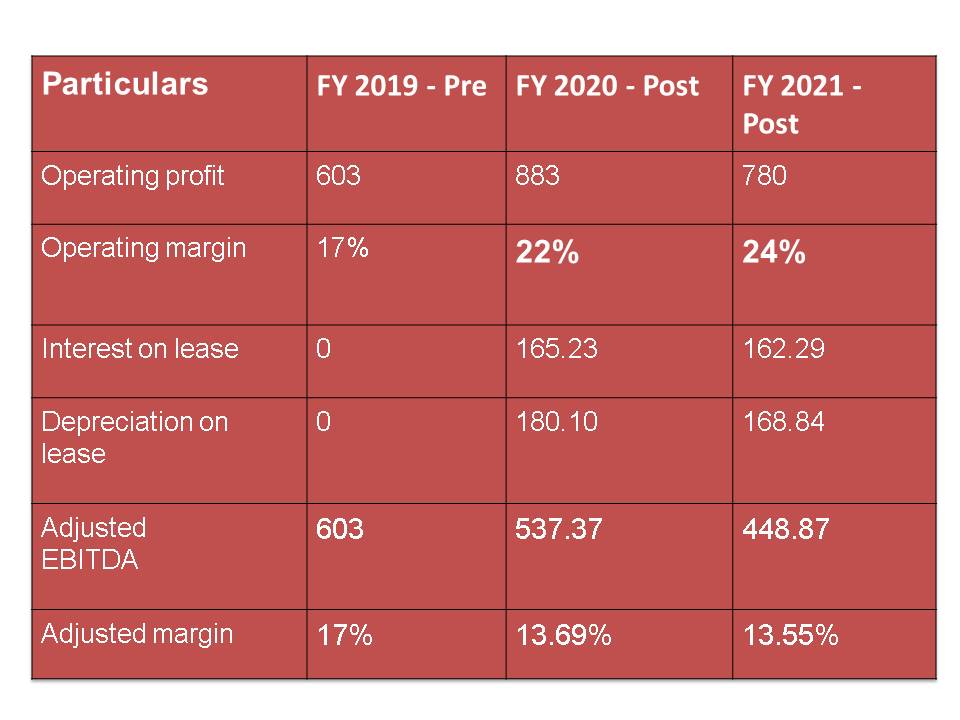

Example: Let us check an example of Jubilant Foodworks Ltd to help us understand the accounting for leases and their impact on margins, ratios and cash flows of the company.

Material Effect of Leases on EBITDA and Margins:

Source: Jubilant Foodworks Ltd.

Source: Jubilant Foodworks Ltd.

Material Effect of Leases on the Cash Flows of the Company:

Source: Jubilant Foodworks Ltd.

Key Points to note when analysing lease in financials:As Lease reporting makes EBITDA volatile it makes more sense relying on EBT.

-

Cash flows are affected by lease in a way that cash inflow in operating activity (CFO) increases and cash inflow in financing (CFF) decreases.

-

If it is a finance lease, ratios such as Asset turnover ratio (efficiency ratio) will fall and Debt to equity ratio (solvency ratio) will rise.

Conclusion: As we saw the example of Jubilant Foodworks Ltd, for accounting of leases we realise the impact of lease accounting on a number of factors. These factors help us better understand the analysis of company financials.

Intangible Asset : Goodwill on acquisition. (IND AS 103)

Goodwill is an intangible asset (An asset that is physically not seen) that is associated with the purchase of one company by another. Specifically, goodwill is the difference between the purchase price and sum of fair value of all the assets purchased in the acquisition and the liabilities assumed in the process. The value of a company’s brand name, solid customer base, good customer relations, good employee relations, and proprietary technology represent goodwill.

When a company gets into a Merger & Acquisition transaction, the parent company can show the goodwill of the acquired company on its balance sheet. Application of IND AS would allow goodwill recognition only when there is business acquisition done by a company of some other entity. Here goodwill is the difference between fair value of assets acquired and the amount of consideration paid. Such goodwill would be an asset that represents future economic benefits. Thus goodwill is considered part of this overall acquired business and not a separate business as such.

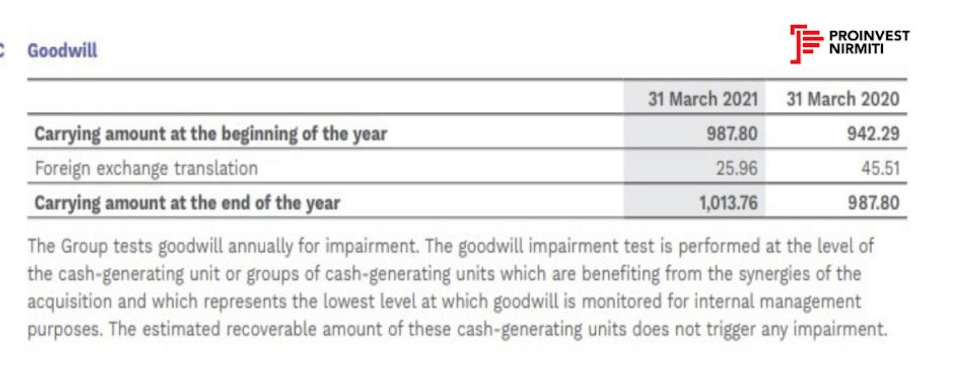

Goodwill on acquisition will not be depreciated like other intangible assets but will be included in the calculation of value of business acquired and compared against the current market value of the business. If the market value of business has reduced as compared to the amount paid for acquisition then goodwill will be written off to the extent of difference.

As per earlier accounting standard 38, the goodwill on acquisition had to be depreciated over a period of time. But because of this interpretation as per IND AS 103, goodwill on acquisition is not required to be depreciated and is carried forward unless there is write off.

The below example from KPIT Tech notes shows the accounting as per IND AS:

Proposed Dividend (IND AS 10)

As per IND AS 10 if an entity declares dividends to equity shareholders after the reporting period, the entity shall not recognize those dividends as a liability at the end of the reporting period. This is because no obligation exists at that time that is at the end of the reporting period. Such dividends are disclosed in the notes to accounts.

As the earlier standard stated, AS 4 – Contingencies and events after balance sheet date, proposed dividend is an adjusting event and the liability needs to be recognized in the period to which the dividend pertains.

Conclusion:

As per Ind AS 103, we understand the reason for not amortising goodwill on the books of the company. This portrays the right picture of the intangible assets of the company and does not pose the reducing value of the business (depreciation of goodwill). The proposed dividend should not be reported as part of liability because the company only plans to pay the dividend rather than making it a liability. This picture helps us better understand the solvency and liquidity ratios of the company. We at ProInvest encourage the investors to be well informed about the stocks they are investing in. Financial literacy is what we aim at, to share our knowledge with curious minds.

AUTHORS: Noopur Patil, Aniket Junnarkar & Prathamesh Rajopadhye