INDIAN ACCOUNTING STANDARDS SIMPLIFIED

Revenue Recognition (IND AS 115)

Introduction: Well you think you could analyze companies by reading their financials, we bet you they could mean a lot different with a deeper understanding of IND AS. Accounting standards are particular rules to present financial data and statements by which their material effect could be influenced. These accounting standards not only regulate companies’ accounting and financial reporting but also make sure that companies across states or sectors are comparable with each other. How companies disclose their financial data can mean different things at different times. Most ways of misguiding the investors that are seen in the industry are inflating balance sheet size, margins and EPS (earnings per share). To reduce financial reporting malpractices, for the benefit of the investors at large, we at Proinvest take the opportunity to mark a few IND AS (Indian Accounting Standards) that could change our outlook on the financials of Indian companies.

In the following range of blogs, we will focus on IND AS for:

- Revenue Recognition

- Fair Value recognition.

- Accounting for leases.

- Intangible assets: goodwill on recognition.

- Proposed Dividend.

- Deferred Taxes.

Let us start with Revenue Recognition IND AS 115:

Revenue seems like one of the most promising factors in analyzing a company’s performance. Until Enron’s fraud, Wall Street was shocked by the effects of revenue accounting gone wrong. Enron would build an asset, such as a power plant, and immediately claim the projected profit on its books, even though the company had not made one dime from the asset. If the revenue from the power plant was less than the projected amount, instead of taking the loss, the company would then transfer the asset to an off-the-books corporation, where the loss would go unreported. This type of accounting enabled Enron to write off unprofitable activities without hurting its bottom line (Profit after Tax). Such reporting of revenue misguides the investors as well as creates an impression of fast growth for the company. This in turn lets the company increase its credibility and allows cheaper borrowing. All these are a few traps where companies showcase fake growth and are later unable to manage their finances leading to insolvency.

What is revenue recognition?

Businesses are analysed on their revenue-generating capabilities. The revenue the company makes must be recorded in its accounting books for preparing year-on-year financial statements. Revenue recognition shows the transfer of promised goods or services in return for an amount.

AS 9 which was formerly (before 2018) in action focused on the aspect of transfer of risk and reward. AS 9 states that revenue should be recognized when there is a transfer of risk and reward. Control is transferred only when the entity has the ability to utilise the goods and services. IND AS 115 states that revenue should be recognized when there is a transfer of control of goods and services and delivery of performance obligations (promise you to make to the customer). Hence every company that has successfully transferred control to the other party and performed their part of the trade obligations can recognise revenue in their books.

Let’s understand this with an example:

Eicher Motors, a company producing iconic motorcycles like Royal Enfield, trades heavily in the national as well as international markets. Suppose the company wants to export its products to the USA. Now on the basis of the performance obligations (contract note) the transfer of control could be based on:

1. The time the goods leave the company’s factory.

2. The time the goods reach the customer’s warehouse.

Thus Eicher motors can now report revenue on its books as and when they have duly performed its performance obligations. In comparison to this, earlier the company would have to wait to transfer risk and reward to the other party, which increases the time gap between manufacturing & shipping of products and reporting them as revenue.

The material effect of revenue recognition:

Earlier the revenue would have been recognized only when goods were actually delivered to the customer. And that would bring about higher sales in that particular month/quarter when they are delivered but portray lower sales in the month they were actually shipped. This time lag between the shipment of goods and their delivery caused misguidance in the volatility of revenue recognition. But now an entity may conclude that the customer has control of redirecting the goods and thus he can recognize the revenue as and when they are shipped. This can result in the company recognising higher revenue.

Under IND AS 115, revenue should also be recognized net of GST and discount. Excise duty is not shown as net of revenue as it is considered to be the production cost. This has majorly impacted companies that offer year-end performance-based discounts to their customers like auto companies, apparel manufacturers, consumer appliances companies etc.

How does this affect company financials?

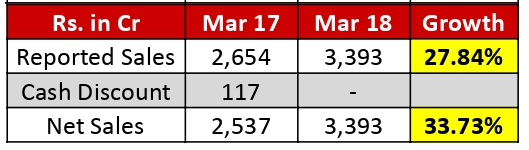

Avanti Feeds, a leading provider of high-quality shrimp feed offers cash discounts to its dealers for faster payments. This amounted to almost 5% of revenue in 2017. Once IND AS came, the company was required to show this expense as revenue net of discount. The below table shows that the company has started netting discounts since 2018 i.e. after the introduction of IND AS as it cannot be found in other expenses for the year ended March 2018. Hence while computing revenue growth for the current year as well as for CAGR (Compound annual growth rate), the discount has to be adjusted in revenue for the previous year.

In the above example, there is a ~6% change in growth because of the revenue underreported according to earlier AS.

Key Takeaways: The next time you invest in equities make sure you check

The growth in 2018 post 2017 as IND AS was applicable from 2018. Some companies might have shown sudden growth/ fall which could be investigated using the revenue recognition rationale.

While taking the topline CAGR, the revenue of the years before 2018 should be adjusted to net of GST, discounts and excise duty.

Conclusion:

Analysing companies based on merely their financials on websites is not the right approach. As an informed investor, one should dive into the company’s statements and understand the effects of accounting on the company’s performance. It is rightly said that ratios portray a company’s performance best, but for calculating accurate ratios, one should be well informed about the meaning of these numbers.

Equity research is an art that tries to make meaning out of numbers and understand the impacts on the stock price. We at Proinvest Nirmiti work at our best to give our best effort each time.

AUTHOR: Noopur Patil